Qualified Business Deduction 2024 Worksheet – The IRS has announced the annual inflation adjustments for the year 2024, including tax rate schedules, tax tables and cost-of-living adjustments. These are the official numbers for the tax year . The percentage of bonus depreciation phases down in 2023 to 80%, 2024 qualified contributions for a sole proprietor are not deductible as a business expense but are a deduction for calculating .

Qualified Business Deduction 2024 Worksheet

Source : www.irs.govY.M.B.A. Business Math (YMBA Business Textbooks and Workbooks for

Source : www.amazon.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comTax Deduction Cheat Sheet For Busy Coaches

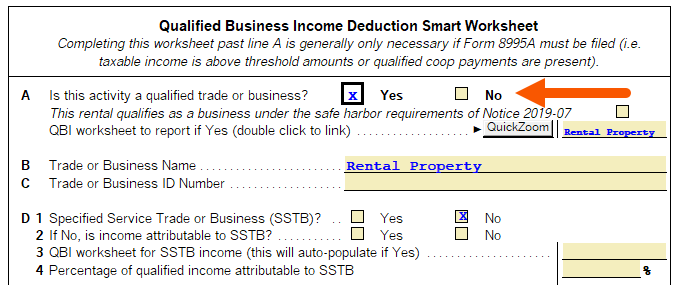

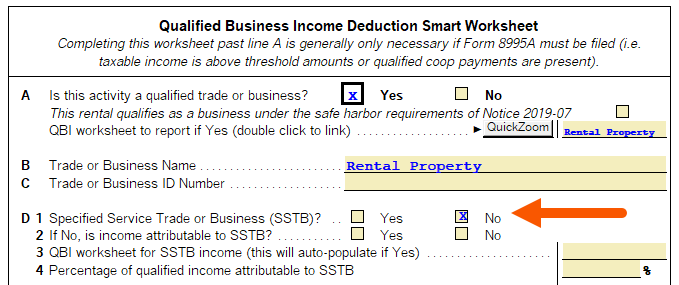

Source : paperbell.comHow to enter and calculate the qualified business income deduction

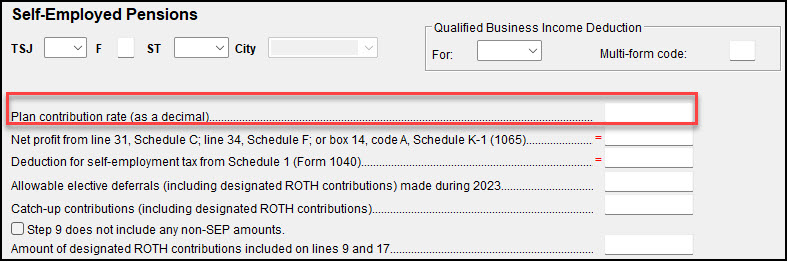

Source : accountants.intuit.com1040 Generating the SEP Worksheet

Source : drakesoftware.comHow to enter and calculate the qualified business income deduction

Source : accountants.intuit.com2023 2024 Two Year Budgeting Planner: Daily Weekly Monthly Budget

Source : www.amazon.comSmall Business Tax Deductions Cheat Sheet, Tax Deductions Item

Source : www.etsy.comQualified Business Deduction 2024 Worksheet Publication 505 (2023), Tax Withholding and Estimated Tax : Ready or not, the 2024 deduction. Bonus depreciation, implemented by the Tax Cuts and Jobs Act (TCJA) in 2017, allows business owners to write off a large percentage of the cost of a qualified . These deductions Business (SEP, SIMPLE, and Qualified Plans).” Internal Revenue Service. “Types of Retirement Plans.” Internal Revenue Service. “401(k) Limit Increases to $23,000 for 2024 .

]]>